Opportunities & Challenges For Export of Indian Dairy Products

My presentation and speech at 39th Dairy Industry Conference of Indian Dairy Association last year. Much of the context and ideas stand relevant and sharing it here with the wider community.

Dear Ladies and Gentlemen,

At the outset, may I thank the Office Bearers & Organizers of the Indian Dairy Association for inviting me to address this August gathering at the 39th Dairy Industry Conference. I am privileged to be with all of you at this Conference and would like to share some of my views on global dairy industry and export potential of Indian Dairy products.

A. INTRODUCTION

Milk & Milk Products are an integral part of human food consumption around the World. Since ages, human beings have relied on milk as their primary source of wholesome nutrition. However, with higher cost of milk production, many people at the lower or middle income around the World are still unable to embrace it as a part of their daily diet. With increasing milk production at one hand and increasing incomes and thereby affordability of consumers at other hand, a gradual shift from basic food products like coarse grains to value-added food like milk & milk products is evident.

In case of India, it has always been hailed as a land of milk right from the times of Indus Valley Civilization and milk consumption has remained high. Further, Indians have evolved their platter with a wide variety of milk products right from Paneer, Ghee, Lassi, Buttermilk to delicacies like Shrikhand, Phirni, Kheer, Paisam, etc.

As far as dairy trade is concerned; Globally dairy sector is probably one of the most distorted agriculture sectors. Producer subsidies are in place in many developed countries, encouraging surplus production, export subsidies are paid by Governments tom push this excess production in the World markets, and tariff & non-tariff barriers are erected by both, developed & developing countries to protect their dairy industry from ‘unfair’ competition. These market distortions are having significant and different impact on producers & consumers in developing & developed countries, which are very difficult to quantify. It has been claimed that, dairy regimes of developed countries, especially Europe & US are devastating farmers of developing World where the livelihoods of thousands of poor small farmers have been destroyed by imports of cheap subsidized dairy products.

In above backdrop, we now look at the global trends in milk production, consumption and trade on one side, while on the other side, we would look at the Indians settled overseas and their demand of Indian milk products.

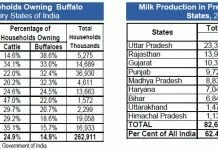

B. GLOBAL MILK PRODUCTION & PER CAPITA AVAILABILITY

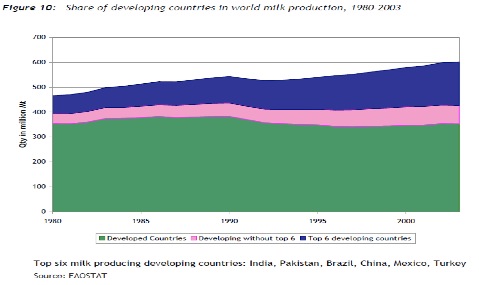

Over the last 24 years, total world milk production has increased by 32 percent; whereas per capita world milk production has declined by nine percent which indicates that world milk production has not kept pace with the increase in world population. The decline in global milk production per capita can be attributed to falling production in the developed countries whereas per capita milk production in the developing countries has slightly risen over the last 24 years. As opposed to the trend towards intensification of milk production in developed countries, production growth in developing countries is to a large part due to increasing numbers of milk animals (and dairy farms) and only to a small part due to productivity gains.

Total milk consumption in developed countries stayed more or less constant over the last twenty years, while significant increases in global milk consumption are due to population growth and per capita income growth in developing countries. The latter has led to the emergence of an affluent middle-class in many low and middle income countries in Southeast Asia, Latin America and Central and Eastern

Europe. Additional “westernization” trends leading to increasing preferences for new value-added products in many of these economies generate additional dairy market growth.

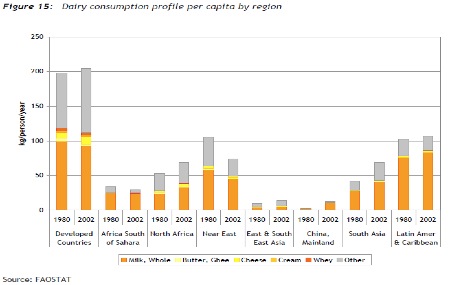

The composition of dairy product consumption varies across different regions with liquid milk as the overall most important product by volume. However, processed dairy products become more important with increasing incomes and living standards, and in developed countries the trend goes more and more towards high value functional foods that require considerable research investments and sophisticated processing.

C. GLOBAL DAIRY TRADE

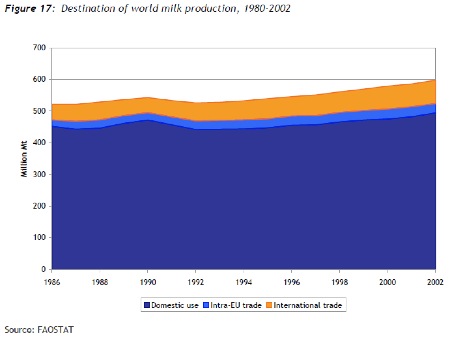

The dairy sector is highly localized, as milk is a bulky and perishable product, and dairy products are mostly consumed in the country or region where they are produced. Only a small fraction of global production is traded internationally. Despite the technological developments in refrigeration and transportation only 7 percent of the milk produced is traded internationally if intra-EU trade is excluded.

Trade in dairy products is very volatile, as dairy trade flows can be affected by

(a) overall economic a situation in a country,

(b) fluctuations in supply and demand,

(c) changing exchange rates and

(d) political measures.

Additional volatility is introduced by the fact that the global dairy market is extremely concentrated in terms of buyers and sellers; hence, supply or demand shocks are not easily absorbed.

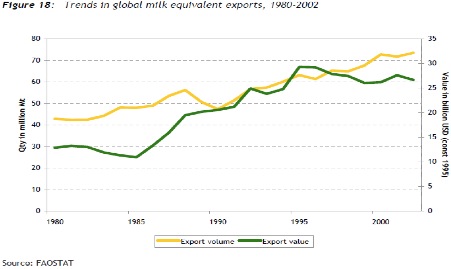

With demand for dairy products most rapidly rising in regions that are not self-sufficient in milk production, volumes of dairy trade are growing. Also the share of global dairy production that is traded will increase as trade will grow at a faster pace than milk production.

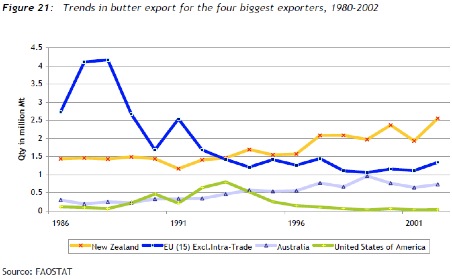

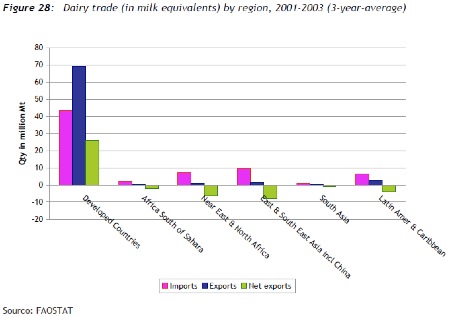

Since 1990, a shift in world dairy exports from high export subsidizing countries, e.g. EU and US towards non-subsidizing countries, e.g. New Zealand and Australia has been taking place. The developed countries account for 62 percent of the world’s dairy imports (measured in milk equivalents) and 93 percent of the exports, showing clearly that the major part of the global dairy trade takes place among developed countries.

In many, and predominantly in developed countries, the dairy market is one of the most heavily regulated agricultural markets. Government interventions in the domestic dairy market are most commonly aimed at controlling quantities of production, establishing minimum prices and guaranteeing farmers’ incomes. Frequently, governments also intervene through public purchases and storage of oversupply or apply policies to foster dairy consumption.

In countries where domestic prices for dairy products are supported well above world market prices, as a consequence, the domestic market has to be protected against foreign competition in order to ensure the market outlet for domestic farmers who would otherwise have difficulties to sell their overpriced products. The major policies countries put in place to limit imports are tariffs and tariff rate quotas (TRQs) and other non-tariff barriers. Globally dairy products are among the agricultural commodities with the highest tariff protection with an average protection level of over 80 percent (the average over all agricultural commodities being 62 percent).

The most important measure promoting exports are export subsidies. Under the WTO Agreement on Agriculture, countries that used export subsidies on agricultural products were required to set commitment levels on the volume and value of export subsidies that could be provided. The most significant user of export subsidies on dairy is the European Union, accounting for over 80 percent of the total value of export subsidies on dairy granted during the period 1995-2001. Over the same period values of export subsidies have been reduced considerably, and in the case of the EU, subsidies for dairy exports in 2001 were only slightly more than 40 percent of those in 1995.

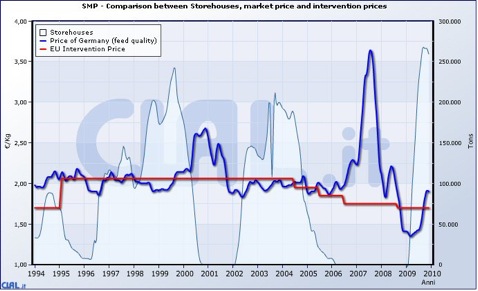

Thus the US and EU are gradually reducing export subsidies as demand is growing due to high GDP growth in developing countries accompanied with import liberalization and tariff reductions as evident from the below graph :

This is also allowing ‘domestic’ producers to realise higher prices for commodities then they were getting when US & EU were subsidising their exports. Therefore, what we call inflation is actually globalization in prices of agri-commodities.

As far as India is concerned, demand for food is growing faster as funds flow in our economy and increase in our GDP. On one hand, Government is under pressure to remove or reduce food subsidy forcing food prices up on other hand it is also passing bill on right for food. Reading all these together you would appreciate that food demand is likely to grow faster than local production and may result in imports.

Compulsion to keep inflation under check will also compel government to reduce import duties to zero as has happened in recent past, in case of milk powder, sugar, edible oil, onion, etc. This pushes domestic producer prices down and may further slow-down production and increase demand-supply gap.

As the demand grows and local production lags behind, international business will expand and provide markets to developed countries’ agriculture and that too at better prices. This enables their governments to cut export subsidies too! In other words, consequent to WTO agreements;

- Right for food has become a reality

- Domestic demand is growing faster than local production

- Developed world is smartly reducing export subsidies as import duties are cut to combat inflation

- Agri-exports from developed world is further boosting their agriculture

- Our domestic farmers’ exports are banned to protect local markets and prevent inflation as our domestic prices rise to global levels.

We have to understand that as our food demand grows and consequent imports happen, World food prices will rise and subsides disappear. Import duties will come down to almost zero. We must protect our farmers’ income even at the cost of inflation as they must receive global prices as do American or New Zealand farmers get. If we let him down at this time, we will end up being an importer in spite of huge domestic production potential.

D. CHALLENGES FOR EXPORT OF INDIAN MILK PRODUCTS

Before I begin discussion on export potential of Indian dairy products, I would like to remind the august audience that we are a nation of almost 120 million people and growing. Our health standards are not so good and our children and youth need to drink much more milk so that we build 21st century India that is tall, healthy and smart. Our mission is to see that every Indian lives for 100 years. By this, I mean both the consumers and more importantly producers as well. And it is for producers’ sake we may have to export some dairy products to keep market interesting! It is clear that our domestic needs are far bigger and we are unlikely to have such huge surplus to export at least till next one decade.

In today’s World, consumer is the king. The image in mind of consumer leads him to decide whether to buy a particular brand or not. Let us become a consumer for a moment and think if you have to buy butter, cheese or baby milk powder in developed country, what would happen?

First barrier you as marketeer may face or likely to face is in getting on the shelf itself! Getting your brand registered and making a deal with food retail chains itself will call for lot of efforts and also you may have to give extra competitive rates sacrificing margins. You may also have to pay more for shelf display. You will have to pay for product registration also. However, in markets lower prices may attract buyer but that too will call for competitive pricing and several conditions on quality etc.

Why do we face such problems? This is because image of Indian milk and milk products such as table butter or cheddar cheese is not high enough to attract western consumers and their food retail chains. Food retail chains in developing countries may come forward if pricing is very competitive and quality reasonably satisfactory.

My point is, we need to address issue of image of our dairy industry. Are we producing Clean Milk? Are our Animals healthy? Does our milk suffer contamination during storage, transport and processing? Are all our dairy plants really well managed? Do we really have strict quality standards in practice? I am sorry to state that on every front, we have miles to go.

I know we love our animals and would like to take as much care as we can but poor living standards and income do not allow us. Our animal health is care is poor. Veterinary services provided are also qualitatively poor except some services provided by dairy cooperatives. Animal Husbandry services are almost absent. We rarely avoid pouring milk of sick animals. We have poor hygiene standards followed in milking, storage, transportation and even in processing. Adulteration is rampant and is increasing day by day, though not as bad as we have seen in our neighboring country where World’s largest dairy company was also a partner. We at least don’t feed offal to our cows and we do not have diseases such as mad cow disease. Yet, our image is poor. We need to make serious attempt to set right these issues.

What I am saying is not for export but more for our own consumers towards whom we have a responsibility to deliver clean milk and milk products. We are the World’s largest producer of milk and all of us are very proud of this. Rightly so as we have done this in very short time and that too with very marginal investment as compared to what government spends on variety of rural development schemes and resultant poor deliveries.

Yet we also must take responsibility and accept the fact we are not the best producer of milk in terms of:

- milk quality

- Storage and handling of milk

- in processing of milk

- in adherence to food laws

- adulteration free milk & products

Our colleges need far better quality teachers, more doctoral programmes and we need basic programmes like ITI programmes in Farm Manangement, Herd Management etc. We need to deploy state of art technologies to improve productivity of our indigenous breeds in a time-bound manner.

Unless we also systematically clean our villages, teach that cleanliness is fundamental to quality of milk production, keep animals healthier, keep our plants clean and follow sound quality management practices; our talking about quality exports is like putting cart before horse.

E. EXPORT POTENTIAL OF INDIAN DAIRY PRODUCTS

1. Milk Commodity Exports:

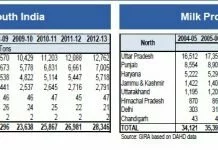

While India is largest milk producer of the World, accounting for around 16% of the global milk production, it is also the largest milk consumer and local demand for milk & milk products is rising rapidly in the country, which may even outpace the supply.

As evident from the above projections, demand for milk & milk products in India is estimated to grow at the fastest pace amongst major food commodities. Therefore, with huge domestic market & buoyant demand, there is limited scope for large scale exports of milk & milk products from the country.

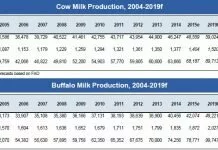

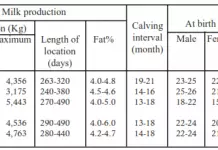

Further, Indian milk producers are fragmented and productivity of milch animals in the country is very low as compared to developed countries as follows:

This leads to higher cost of production for milk in India as evident from the below graph:

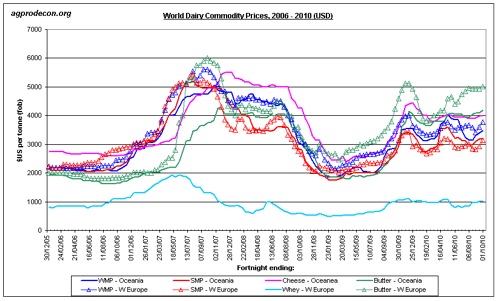

Further, the global commodity trade is highly volatile and prices for these commodities are set by New Zealand, being the largest exporter as evident from below graph:

As discussed above, Global commodity market is highly volatile and Indian players would have to compete with highly competitive players from New Zealand & Australia on one hand and subsidized exports from US & EU on the other hand. Further, India would not have enough volumes to establish long-term trading relationships with major importers. Therefore, there is very limited scope for exports of milk commodities from India.

2. Change in Eating Habits of Indian Consumers and Influx of Western Dairy Products in Indian diet

Western Dairy products like Table Butter, Cheese, etc. are taking a larger pie of the Indian platter eg. Demand for table Butter is estimated to grow by 8% per annum while that Cheese is estimated to increase by more than 20% per year for next 10 years.

This demand is also aided by explosion of fast-food (or Quick Service Restaurant) chains like McDonalds, Pizza Hut, Dominos, etc. in the Indian market. In 2006, the global fast food market grew by 4.8% and reached a value of 102.4 billion and a volume of 80.3 billion transactions. In India alone, the fast food industry is growing by 41% a year.

McDonald’s is located in 126 countries and on 6 continents and operates over 31,000 restaurants worldwide. There are numerous other fast food restaurants located all over the world. Burger King has more than 11,100 restaurants in more than 65 countries. KFC is located in 25 countries. Subway is one of the fastest growing franchises in the world with approximately 39,129 restaurants in 90 countries as of May 2009, Pizza Hut is located in 97 countries, with 100 locations in China, Taco Bell has 278 restaurants located in 12 countries besides the United States. If we make a corollary with the US fast food market for the year 2010, it is 4% of the national GDP with size of US$ 580 billion and has 49% share of the consumer spending on food.

Source: National Restaurant Association, USA, 2010.

As evident from the above example of US market and fast replication of such fast-food chains in India, demand for western dairy products in India is estimated to increase at even faster pace.

3. Demand of Indian Milk Products by Indians settled overseas

Immigration from India is on the rise and will further increase. Aging population in developed world is going to need higher & more diversified immigrant workforce.

This alone is going to lead to higher exports of ethnic Indian food. Indian Diaspora settled out of the country is very huge as evident from the following figures:

| Region | PIO Population (Lakhs) |

| North America | 32 |

| South-East Asia | 30 |

| Middle East | 57 |

| South Asia | 26 |

| Europe | 24 |

| Africa | 24 |

| Central America | 12 |

| Pacific | 11 |

| Rest of World | 4 |

| Total | 220 |

Source: Ministry of Overseas Indian Affairs

As evident from the above figures, there are around 220 Lakhs Indians who have settled abroad. Considering Indians studying or working abroad on temporary permits as well as illegal migrants; the figure would swell to more than 4 crore Indians living outside the country. Since they are habituated with Indian palate, requirement of Indian Dairy Products like Ghee, Paneer, Sweets, etc. is very large.

Further, due to their association with India, they have special affinity to Indian brands or dairy products originating from the country. The affluence of these people being higher, their consumption is also higher and they are ready tom pay premium for Indian dairy products as evident from the exports volume of major Dairy Companies from the country.

Considering per capita requirement of 50 Kgs of Indian Dairy Products per year, the estimated market size for Indians residing abroad exceeds 2 Million MTs.

4. Demand of Indian Milk Products by Indian Restaurants abroad

With more & more Indians living the country and settling in various parts of the World and also inclination of outsiders for Indian culinary dishes, restaurants serving Indian food have spread across the globe.

As was the case with huge growth in western style fast-food restaurants in India, Indian restaurants are also growing like wildfire in various parts and according to listings available on the web, around 15,800 large-scale Indian restaurants are already functioning out of the country. If we consider small scale & motel type restaurants serving Indian food, the no. would increase to more than 50,000 by any estimates. Further, the growth of these restaurants is estimated to be more than 40% every year.

Apart from that, more than 20 million Indians travel abroad every year and they prefer Indian meals not only at their places of stay but also during their flights. Therefore, almost all International Airlines flying more Indians, offer Indian meals and they also require Indian dairy products in large quantity on regular basis. For eg. Monthly requirement of Paneer by Emirates Airlines for their Dubai hub is in excess of 150 MTs.

At the same time large pool of business class is going be exposed to India and Indian foods and thus large number of Indian restaurants are going to mushroom all over the world out numbering pizza huts and Macs.

These restaurants require Indian dairy products like Paneer, Ghee, Khoa, Chenna, etc. as an integral part of their recipes and looking at their volumes, provide huge opportunities for Indian Dairy sector. Further, they already have their sourcing of ingredients like spices, etc. from India and are well aware about Indian brands present in this sector.

Considering requirement of 500 Kgs of Indian Dairy Products per month per restaurant, the estimated market size for Indian restaurants abroad exceeds 5 Million MTs.

F. STRATEGIES FOR EXPORT OF INDIAN MILK PRODUCTS

Under such situation where do we begin? Where is our export niche market? Thus for Indian dairy industry, real niche is going to blossom for:

- Pure Ghee

- Paneer

- Rasagola, Gulab jamun and such ethnic dairy products.

Either we process and sell products under our brands or license our brands using local material when vaible. But leveraging our dairy products like Ghee, Paneer, etc. gives us natural edge over others and enables to realise better returns.

We also create mechanized process to manufacture products more hygienically and uniform in quality.

As for exports of milk powders or casien etc. these are commodity exports and therefore subject to fluctuating returns. Here too, progressively we are likely to become more competitive. But with huge domestic market and growing consumption, India becoming a big player in commodity business is unlikely at least for next decade.

One more way is to acquire running dairy plants in fodder, milk and labor deficit areas and build our own markets eg. Middle East, Singapore, Hong Kong.

G. CONCLUSION

While India is the largest milk producer in the World and rate of growth in milk production exceeds 4% per annum, it is also the largest milk consumer and demand for milk & milk products is estimated to surpass supply with current trends in consumption. As far as prospects for exports of Indian Dairy Products are concerned, there is very limited scope for exports of milk commodities from the country owing to very little surplus generated and stiff competition in the International Trade apart from high price volatility in the market.

Further, with the influx of western style fast-food chains in India, consumption of western dairy products is increasing in the country at a very fast rate.

However, with more than 4 crore Indians living abroad and spread of more than 50,000 Indian restaurants across the globe, there is huge demand for Indian Dairy products these classes. It provides some very strong advantages for Indian Dairy Companies as follows:

1. No competition from other countries

2. Firm requirement round the year

3. No price volatility

4. Consumer pack market

5. Opportunity to expand brand in other countries

The august gathering at this Conference may therefore decide appropriate strategies for developing export market of Indian Dairy products as above.

Mr. BM Vyas took-over as Managing Director of AMUL Co-Op. during expansion and opening up of the Indian economy & globalization in the 90s. In order to take on the competition, he championed Total Quality Management across the dairy value chain in Gujarat. Within a span of 16 years at helm of AMUL, he increased sales of AMUL to eight-folds (from Rs. 9.8 billion to Rs. 80 billion). He steered AMUL to be Asia’s largest fresh Milk processor or No. 1 Dairy Brand in India as well as in Asia Pacific, as per Media Magazine Survey, 2009. Under his leadership; AMUL launched innovative and special Dietary products like Probiotic & Sugar Free Ice Cream, Probiotic buttermilk for the first time in India.

Comments

comments