Source: businessworld.in

Carlyle, one of the world’s largest private equity (PE) groups, is in advanced talks to invest in the dairy business of publicly-listed diversified group Anik Industries.

The company’s dairy business operates under brand ‘Sourabh’ and includes products like spray-dried milk, ghee and whole milk. Apart from the flagship dairy business, the Indore based company is also engaged in the business of wind power, coal, agri commodities and real estate, among others.

If the talks fructify, this will be one of the larger private equity deals, said a person with direct knowledge of a development. Anik has been looking to hive off the dairy business for some time now. In fact, on June 10 this year, it issued a statement to the stock exchanges saying that it needed to undertake restructuring or strategic action in respect of the dairy business.

Even as the exact deal size could not be ascertained, a senior industry executive close to the company said the deal size could be at over Rs 200 crore. While an email sent to Anik Industries did not elicit any response, the Carlyle spokesperson declined to comment on the development. “Carlyle has no comment on this,” he said over an email response.

Anik Industries’ scrip closed at Rs 28.40, 2.91 per cent on Thursday (Oct 29), lower than yesterday on Bombay Stock Exchange on a weak market. Overall, Sensex closed 0.75 per cent lower at 26,838.14 on Thursday. For the fiscal ended FY14, total revenues of the company stood at Rs 1,504.78 crore with net profit of Rs 11.11 crore.

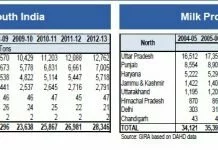

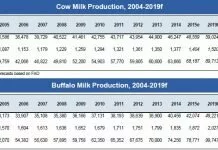

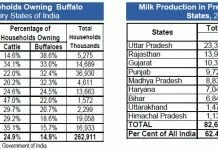

The dairy business has been evincing significant investor interest with demand for milk and milk products witnessing a significant rise in India over the last few years. In fact, as per data available with the National Sample Survey Office, the per capita monthly expenditure on milk and milk products increased from Rs.41.9 to Rs 115 in 2001-02 to 2011-12 in rural India. In urban India, it jumped from Rs.75.8 to Rs.184 during the same period.

This is even as the overall FMCG sector has seen a decline in the number of deals this year from that of last year. “Hardcore consumer players still remain a good investment proposition,” said Raja Lahiri, partner at advisory firm Grant Thornton. “It is not easy to build a brand in India. People need funds to build them,” he added explaining that it may be the fringe players which have seen a dip in investment activity. FMCG as a category is vast with diverse sections like consumer and food and beverages featuring under it. There is still significant investor interest in dairy products, companies that make juices and food.

In the dairy segment, Motilal Oswal Private Equity was recently in news for a proposed investment in Hyderabad-based dairy firm Creamline Dairy Products Ltd. The PE firm earlier invested in Parag Milk Foods.

Comments

comments