Source:freepressjournal.in

Milk as a consumption item has never failed to excite India. But it was Dr. Kurien who gave a new impetus to the supply side of milk as well. He did this through the NDDB (National Dairy Development Board) and the GCMMF (Gujarat Cooperative Milk Marketing Federation).

And he created the Indian version of the milk co-operative movement which has transformed this country. The results are visible – India is the premier producer as well as the largest consumer worldwide. That, too, with small farmers – each having between 2-10 heads of cattle as a backyard dairy farming. More significantly, this industry grew with practically no subsidy from the government.

What makes the Indian milk movement unique is its ability to pay 80% of the market price to the farmer. Kurien ensured that everything else – milk collection, processing, packaging, distribution and marketing – was managed within 20% of the marketing cost. That made the farmer earn more, which incentivized him to produce more. For Kurien the small farmer was crucial. He believed in production by the masses, not mass production.

Milk thus provides income for farmers, nutrition for Indians, and rural prosperity for the economy. With Modi’s vision of doubling rural incomes, milk is bound to play a bigger role.

To discuss this, the FPJ-IMC Forum organised a panel discussion with experts at the Indian Merchants’ Chamber, Mumbai. The panel comprised T. Nanda Kumar, Chairman National Dairy Development Board (NDDB); R.S. Sodhi, Managing Director, GCMMF popularly referred to as Amul; Mahesh Pathak, Principal Secretary Animal Husbandry, Dairy Development & Fisheries, Government of Maharashtra; and Madan Sabnavis, Chief Economist, CARE. The event was moderated by R.N.Bhaskar of FPJ with editorial support from Pankaj Joshi, and Lalit Wadhwani.

The welcome address was given by Dilip Piramal, president, Indian Merchants’ Chamber (IMC) and the vote of thanks by G. Chandrashekhar, Economic Advisor, IMC.

Significance of the milk industry

Nanda Kumar: If agriculture’s contribution to GDP is so low, why is dairy important? About 33% of agri-GDP is dairy, and more importantly, we have about 50% of people in agriculture. In Dr. Verghese Kurien’s words, we at Amul are not in the business of dairying, we are in the business of rural prosperity.

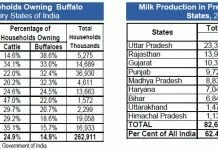

Regarding the [recent] Budget the government’s aim is to double farmers’ incomes by 2022. It is impossible to do this without dairy. Dairy is a more equitable agri-occupation. 85% of the small and marginal farmers in India own 45% of the land, but own 75% of the bovine. For a landless person, dairying is one of the best occupations.

Nanda Kumar, Chairman National Dairy Development Board (NDDB)

Nanda Kumar, Chairman National Dairy Development Board (NDDB)

“Doubling farmers’ income by 2022 is impossible without dairy farming which has a CAGR of 19.6%. 85% of the farmers in India who are marginal and small own 45% of the land, but 75% of the bovine. So probably for a landless person, dairying is one of the best occupations”

In a country which is predominately vegetarian how do you handle children between six months and five years without dairy? Also, we’ve always worried about the levels of under-nutrition.

Sodhi: Today we have become not only the world’s largest producer and consumer, but also self-sufficient, because the Amul model gave all a win-win situation. India is the only country where farmers get 80-85% of what consumer pays. In most of the world, farmers get only one-third.

Processors accessed a good system to procure from millions of farmers, process it and market it. Lastly, consumers are very happy to get very hygienically packed nutritious milk at a very, very reasonable cost vis-à-vis other countries.

We have to see how we can continue to grow and how we can encourage tomorrow’s generation to go for this profession. Dairy can help in the ‘Make-in-India’, in the rural areas where most of the population lives, since you do not require much land. It can provide a livelihood source to the maximum people in rural India.

Pathak: For doubling rural incomes, animal husbandry, dairy and poultry are important. These reduce the farmer’s risk, mitigate the strain when rains are not good, keep income flowing. Our aim is that the farmers’ income comes throughout the year and not seasonally.

Sodhi: If you ensure a remunerative price on a continuous basis to the farmer, the farmer will produce milk. In Gujarat there is a district called Banaskantha, which is a very semi-arid area on the border of Rajasthan desert. About 45 years ago when co-operatives were formed there people said, when there is no water how can you produce? Today that district gives 45 lakh litres per day, which is the maximum all over India.

4-5 years ago we went to Kolkata and the people said West Bengal has no milk. Now whatever milk we are selling in Calcutta in year is procured locally.

Milk industry background

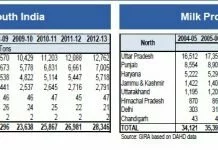

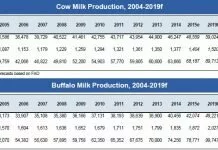

Nanda Kumar: The story of milk production growth is well known, from 22 million tonnes in 1970 to 146 million tones of milk in 2015. The monetary value of this is more than the current combined value of rice and wheat, and this was achieved without subsidy and incentives. The important element in this growth was the farmer institutions, which worked on three basic principles of ‘trust, transparency and technology’. With a base of small farmers, we are 18% of global production.

Sodhi: There was a time in the ‘seventies when you had to have the aluminum card of Delhi Milk Scheme to buy two bottles of milk – that too, if you stood in the queue two hours before the booth opened. India then was producing only 20 million tonnes of milk and this was static – we were dependent more on imports from the developed countries, Australia and New Zealand. Thanks to Dr. Kurien, the model of Amul was created, and replicated, and today we are self-sufficient, whereas most of our neighbouring countries are still importers from the same nations.

Growth opportunities

Nanda Kumar: There is a shift in food expenditure, with spend on staple cereals coming down and milk rising. Food spend today is on high value agriculture, including fruits, indicating a prosperous and aspirational India.

International studies are looking at a growth of about 19.6% CAGR till 2020 for India’s dairy market. Consensus is that India’s GDP growth cannot be below 7-8%. Combine this with urbanization. In another 8-9 years 50% of India is going to live in cities, and a hundred of them will be smart cities. Also right now we process only 20-22% of output. Any increase here will contribute to growth.

Both public and private sector can grow with the same basic principles. How transparent you are, how much trust the farmer has in you, will ultimately determine whether you can work with the farmers.

R.S. Sodhi, Managing Director, GCMMF (Amul)

R.S. Sodhi, Managing Director, GCMMF (Amul)

“India is the world’s largest producer and consumer of milk and the only country where farmers get 80-85% of the MRP. In the ‘70s India’s production was 20 Million tonnes and per capita consumption was 110 gms. Today production is 146 Million tones and per capita consumption is 340 gms.”

Sodhi: In the ‘seventies India’s per capita consumption was 110 gm. Today it is 340 gm. along with increase in population, consumption is growing because of prosperity.

From today’s population of 1.25 billion, it is expected that by 2050 it will be around 1.7 billion. With growing consumption, if today we consume 150 million metric tonnes, by 2050 we will consume three times more. When value-added products increase, industry growth will be beyond three times in value terms. People involved in the dairy industry, whether in production, processing or marketing, are very fortunate, because it is definitely going to grow.

Pathak: Population growth, demography, rising incomes, all will keep dairy industry demand in a very comfortable position. Our target is to produce some 220 million tonnes by 2020. Private sector role is vital, especially when nearly three-fourths of the industry is unorganised. They have to enter even production, which today is substantially unorganised and hence has lot of inefficiencies. Integrated dairy farms is the next opportunity for the private sector. For co-operatives, there is opportunity in regional imbalance in the eastern, north eastern and extreme northern regions.

Recently there was a FSSAI report that almost three-fourths of the milk samples are failing the test, even for pouched milk. Most of the milk sale is non-standardized, from local suppliers, and

most of the test-checking is done on the organised sector. The move to being organised is important from the point of safety, and also from the point of better prices to the farmers.

Nanda Kumar: Uttar Pradesh is a classic case in point, where about 1% of the total milk production is procured through cooperative routes. It’s ready for large players, like Amul and

Mother Dairy. So is Eastern India which has adequate natural resources, where 27% of the cattle population gives 17% of milk. What they lack is good breeds, good institutions and probably a good marketing infrastructure.

Madan Sabnavis, Chief Economist, CARE

Madan Sabnavis, Chief Economist, CARE

“The dairy industry stands on four pillars 1: Output – dairy segment output is highest in value terms in the entire primary sector. 2: Demand – As rural incomes rise, a progressively larger proportion will be spent on dairy products. 3: Employment – 70-75 million households are dependent on dairy farming. 4: Price – in 1988 the price was Rs. 2 per litre of milk, which is around Rs.40 today”

Sabnavis: Let us look at a macroeconomic model. The dairy industry stands on four pillars. First is output. The dairy segment output is highest in value terms in the entire primary sector. To grow the primary sector, focus on where the value lies. Second is demand. As rural incomes rise, a progressively larger proportion will be spent on dairy products. Demand for milk will increase, and production can grow in tandem.

Third is employment. It has been mentioned that 70-75 million households are dependent on dairy farming. To enhance employment in the rural areas, we have to look for a factor with the greatest potential. Focussing on dairy segment would help halt migration from rural to urban areas.

Fourth is price. In 1988 or 1989, price was Rs. 2 for a litre of milk, which is around Rs.40 today, quite clearly a big increase, outpacing the WPI. If you are working in this segment there’s a good chance that your income will keep increasing, it will keep pace with inflation. Also when prices of agricultural products go up, there’s a huge noise, but for dairy products nobody has ever complained about paying higher prices.

Sodhi: India’s milk consumption is 340 gm per person per day, varying across states. In the North it is 600-700 gm, in the North East, it is 100-120 gm and West will have 300-400 gm. In Europe, it is 850 gm. In India around 30-40% are malnourished, and milk is the best source of nutrition, with protein and fat.

Current global and domestic position

Sodhi: At present, the dairy industry worldwide is facing stress. In Australia and New Zealand, prices are lower by 60% compared to two years back. European prices are 30-40% lower.

There are four factors behind this. China, a large importer, has reduced imports. Russia has started to reduce or totally ban import of dairy products from European nations. Third is the in-tandem production rise in the European Union nations, which abolished their quotas on milk production in 2015, and started competing with Australia and New Zealand. The last is the crude price crash. Crude oil exporter nations are all dairy product importers.

Across India too, farmers today get 20-60% lower price of milk. But in Gujarat – where we procure 20 million litres of milk daily – farmers are getting 2-5% more prices compared to last year, because in Gujarat 93% of the milk is converted into value-added products and marketed. With a commodity market of just 7%, farmers are not exposed to price volatility.

Sabnavis: In case we are actually self-sufficient, we can think of exports as an avenue. For this, the industry has to become more organized, convert milk into manufactured products.

Challenges to growth

Nanda Kumar: We have serious issues of low productivity, which emerge from some indigenous breeds and also from our feeding challenges. Another challenge is pressure on feed, fodder and water due to climate change. Processing and support infrastructure is far from adequate for growth of 19.6%.

There is also the new definition of food safety and its newer challenges. Maintaining quality is a task when milk is collected, processed and probably sold twice a day.

Sodhi: Gradually we will have more mouths to feed and lesser hands to produce thanks to population growth and urbanisation.

How can we encourage rural India to produce more food? How do we attract the younger generation to the dairy industry? Only if they find it commercially remunerative, and also more glamorous via modern industry techniques.

Sabnavis: Increasing cattle livestock could lead to environmental issues. Second, in India once cattle stop giving milk, we destroy them. The current ban which you have on beef – do we have the wherewithal to actually look after cattle once they stop giving milk?

Support requirements

Mahesh Pathak, Principal Secretary Animal Husbandry, Dairy Development & Fisheries, Govt of Maharashtra

Mahesh Pathak, Principal Secretary Animal Husbandry, Dairy Development & Fisheries, Govt of Maharashtra

“Population growth, demography, rising incomes, all will keep dairy industry demand in a very comfortable position. Our target is to produce some 220 million tonnes by 2020. Private sector role is vital, especially when nearly three-fourths of the industry is unorganised”

Pathak: For integrated animal husbandry development, we need for better hospital infrastructure, as also better extension services. Departmental allocations – for farm development, for better quality of semen and artificial insemination, for improving the producer companies, for providing dairy infrastructure – have to go up, in order to double farmer incomes. The targeted production growth will strain the feed and fodder situation.

Sabnavis: The NREGA wage can be a good support tool to compensate farmer for fodder. With the Government promoting small banks dedicated to priority lending, purchase of cattle can be financed. The National Rural Livelihood Mission (NRLM) can provide a back-ended subsidy.

Nanda Kumar: We need a much better hold on the unorganised sector through the Food Safety Act. FSSAI should focus on loose milk and the kind of milk that is still sold in packet without branding and processing. We have to analyse the process capability of every processor to ensure that the customer gets a safe product. Strengthening institutions is something that we have to focus o

Pathak: The Government of India has given an advisory that SMP [skimmed milk powder] may be used in school education program. If The Government of India includes this in the ‘Sarva Shiksha Abhiyan’, even one day a week is enough. Gradually we can get into the school program, but we need Government help.

With more artificial insemination we need less male animals, which will improve productivity and commercial viability.

We are working on a milking machine for a single cow, which would be an inducement for small farms and younger people. About NRLM, it is more crucial that farmer be able to sell the milk and make money.

Nanda Kumar: At the purchasing centre, you need a technology that demonstrates that the farmer is getting paid fairly. Fat content measurement, solids-not-fat (snf) measurement, transparent payment systems are important to gain trust.

Nanda Kumar, Chairman National Dairy Development Board (NDDB)

Nanda Kumar, Chairman National Dairy Development Board (NDDB) R.S. Sodhi, Managing Director, GCMMF (Amul)

R.S. Sodhi, Managing Director, GCMMF (Amul) Madan Sabnavis, Chief Economist, CARE

Madan Sabnavis, Chief Economist, CARE Mahesh Pathak, Principal Secretary Animal Husbandry, Dairy Development & Fisheries, Govt of Maharashtra

Mahesh Pathak, Principal Secretary Animal Husbandry, Dairy Development & Fisheries, Govt of Maharashtra