Global dairy players unsure of India entry

Restrictions and controversies over cow slaughter could be a hurdle for the policy initiative to attract foreign investment to the animal husbandry (dairy) sector, industry insiders say.

While the government has allowed 100 per cent foreign direct investment (FDI) in animal husbandry (including breeding of dogs), pisciculture, aquaculture and apiculture under automatic route, industry executives feel global dairy giants may be reluctant to come in because of the blanket ban on cow slaughter.

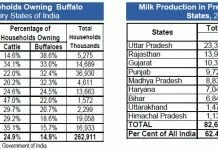

“Globally, non-milking cattle goes to slaughter house, which is not the case in India. So it’s a big challenge for global dairy companies that want to enter the Indian market,” said Kuldeep Saluja, managing director at Sterling Agro Industries Ltd, maker of Nova brand of dairy products. “Not being allowed to slaughter certain cattle is a huge drawback in India for global dairies,” he said.

In international markets unproductive cattle, most of which are cows, after being in dairies for 14-15 years, go to slaughter houses. A company expects 50-60 per cent return on investment on sale of each cow.

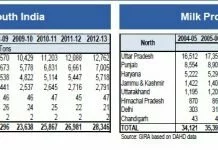

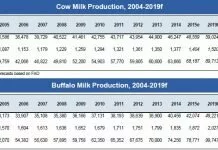

Saluja said 95 per cent of the cattle used in commercial dairy farming globally are cows and not buffaloes, unlike India. Hence, he said, the country is not lucrative for companies to attract FDI in animal husbandry sector.

In the past few years, global dairy firms such as Fonterra of New Zealand, French cheese maker Fromageries Bel, Denmark’s Arla, Dutch dairy cooperative FrieslandCampina, Mexico’s Grupo Lala, and Germany’s Hochland Group have scouted the Indian market for opportunities to set up own units or to partner with local players.

Promoter of a leading national private dairy company from South India who requested not to be identified said globally dairies would get 50 per cent-60 per cent of the cost they paid for the cattle by selling to slaughter house. In India, dairy companies send old and unproductive cattle to a gaushala or sell them to small farmers at a much

Another reason why foreign players may be reluctant to enter the country, private dairies feel, is that they may find it hard to compete with dairy cooperatives that get favourable treatment from state and central governments. However, some dairy companies in private and cooperative sectors, said FDI in dairy sector will help Indian dairy companies looking for funds, and lead to new dairy products and better farm practices.

“Any investment beneficial to Indian farmers and dairy industry will be good,” said RS Sodhi, managing director at Gujarat Cooperative Milk Marketing Federation (GCMMF) that owns the country’s top dairy brand Amul.

“I am studying on the FDI in animal husbandry issue and a better picture will emerge in the coming days,” he said. Similarly, Pritam Shah, MD at Parag Milk Food that sells ‘Go Cheese’ cheese brand, said 100 per cent FDI in the sector will boost investment flow in the sector.

“There will be expansion in dairy products category and we might see more varieties of baby food or cheese products,” he said. Significant investments have been made by global dairy majors like Schreiber (US) with Dynamix Dairy (Maharashtra) Lactalis with Tirumala Dairy, Britannia, Nestle and Danone among others in India.

As per FDI Policy 2016, the government has done away with the requirement of ‘controlled conditions’ for 100 per cent FDI in animal husbandry.

Comments

comments