Trade talks that could milk India dry

During the recently concluded Ministerial level meet on Regional Comprehensive Economic Partnership (RCEP) at Laos, India officially communicated its position to consider a uniform yardstick for elimination in number of tariff lines. This is a significant shift from its earlier position of a three-tiered approach to tariff reduction. In return, India is pushing for liberalization of trade in 120 services — an area in which it apparently enjoys comparative advantage over other members of RCEP.

Three tier approach discarded The three tier approach to elimination in tariff lines proposed by India earlier divided the 15 members of RCEP into three groups. The first group consisted of the existing members of ASEAN — three of them considered as low income countries as per the World Bank classification, namely, Cambodia, PDR Lao and Myanmar.

The second group includes Japan and Korea — countries which have simultaneous free trade agreements (FTA) with ASEAN and India. The third group includes Australia, New Zealand and China. These three countries have FTAs with ASEAN but are yet to ink such agreements with India.

India offered to eliminate 80 per cent of the tariff lines with the countries clubbed in group 1 on a reciprocal basis with 65 per cent of them being made effective once the RCEP would come into effect and the rest over an extended period of 10 years.

Proposed tariff line elimination for second and third group of countries were pegged lower at 65 per cent and 42.5 per cent, respectively, to be phased out over time. To the uninitiated, tariff lines are products defined at a highly detailed level for the purpose of setting import duties.

Impact on dairy sector This change in strategy brings to the fore an important issue vis-à-vis the Indian dairy sector. As long as India had proposed to follow differential rates of elimination of tariff lines with minimal levels of elimination proposed for Australia, New Zealand and China, there was not much of a threat to our dairy sector.

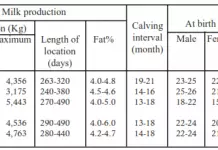

New Zealand and Australia are the leading exporters of milk and dairy products in the world. Both of them enjoy a high degree of comparative advantage globally over their competitors.

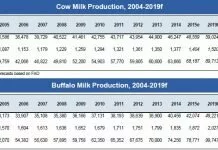

New Zealand recorded a self-sufficiency index of more than 500 in 2013, indicating that out of every five units of milk and milk products produced there, only one unit was used up for domestic consumption. The rest of the produce is required to be exported, else they would lie as unused stocks in storage houses, creating an obvious drag on future prices and capacity utilization in dairy sector, thereby affecting the economy.

Australia recorded a self-sufficiency index of 127, still indicating considerable excess production of dairy products over domestic consumption requirements. On the other hand, the Chinese estimate of the same index stood at 81 — indicative of a significant deficit in domestic production compared to internal consumption requirements.

The rest of the RCEP members are yet to be self-sufficient in milk and milk products. The new dispensation of equal treatment by India to all 15 members of RCEP in terms of elimination of tariff lines potentially opens up a much larger possibility — of Indian milk producers facing strong competitive pressure from the dairy sectors in New Zealand and Australia.

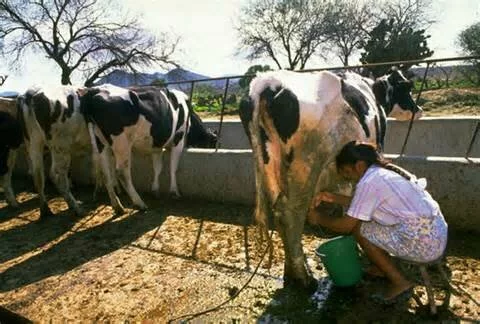

Livelihood concerns Are Indian dairy farmers ready to compete with their counterparts from New Zealand and Australia? Is it necessary for them to compete with them? Perhaps both the questions are to be answered in emphatic negatives.

In today’s competitive world, exports are conditioned by the capacity to produce beyond domestic production. The gap between cost of production and the price of the products, both in domestic and international markets which are often not free from manipulation or distortion of one kind or the other, too determines the capacity of a country to export.

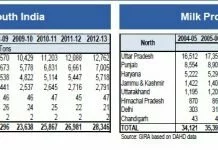

Incidentally, India’s self-sufficiency index in dairy products was measured as 101 in 2013. Per capita annual milk consumption in India is not very healthy compared to global standards. It was recorded at 123 kg of milk equivalent in 2013, compared to 328 kg in Australia, 259 kg in the US, 214 kg in Argentina and 180 kg in Brazil. This is in spite of the fact that India is the largest producer of milk in the world.

India is not export competitive in any of the 21 dairy products traded globally. However, the Indian dairy sector is surely capable of taking care of present domestic requirements. With milk production increasing at a healthy rate, the country is well poised to maintain its self-sufficiency even though per capita consumption of milk in India is steadily increasing at more than 2 per cent per year.

Thanks to “Operation Flood”, we have been quite successful in safeguarding the interests of our vast millions of resource-poor milk producers as well as that of our domestic consumers. However, India is yet to acquire enough commercial intelligence to handle unforeseen fluctuations in global trade. It would have to undertake large scale domestic institutional reforms, including handling of import quality, to establish herself even as a small global player in the dairy sector in the years to come.

The threat to Indian dairy sector through RCEP, in view of the recent change in negotiation strategies, comes from New Zealand and Australia. The cost of production of milk in here is more or less similar to that in India; so milk products from these countries will be price competitive vis-à-vis domestic products, if existing tariffs are altogether or even partially eliminated.

Given the excess production capacity in these countries, they can engage in large scale export without impacting domestic price levels. It is imperative that the domestic dairy sector is protected through appropriate policy instruments, till the required domestic reforms are initiated.

A unique feature of Indian dairy sector is the high share of the consumer rupee flowing into the hands of the primary milk producers, thanks to the extensive network of dairy cooperatives.

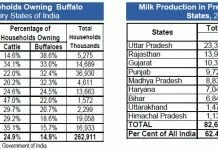

It supports around 75 million households with small landholding, mostly owning two or three cattle or buffaloes. Opening the milk sector hastily to competition will be a recipe for disaster unless the small producers are provided with policy support – the most important being access to cheaper credit and integration with the extended value chain.

The next round of negotiations begin today in Ho Chi Minh City, Vietnam. The shift in India’s strategy in favour of opening up the goods sector uniformly to competition from all other signatories of RCEP should be reconsidered. A gain for one small organized group may be accompanied by a loss to a much larger but relatively unorganised group — the dairy sector.

The writer teaches at School of Business Studies & School of Law, Sharda University

Comments

comments