Janmashtami special: Dairy stocks can make big money for you if you stay put

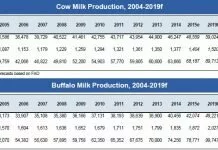

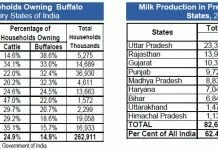

As India celebrates Janmashtami, the birthday of Lord Krishna, we had a look at the potential of the dairy sector, which promises good times ahead for investors. Companies in the businesses of milk processing and milk products could turn out to be great wealth creators in the times to come, said analysts. One reason for that is the scale. India is the world’s largest producer of the dairy products and also has the largest consumer base.

Currently, the size of the Indian dairy industry is estimated at approximately Rs 4 lakh crore, with organised players holding just 30 per cent market share. “The dairy industry in India is growing in double digits annually over the past five years. However, organised dairy players have grown twice as fast in the same period. Organised dairy players are expected to do better over the next few years as rising disposable income and increasing quality consciousness will lead to greater consumer preference for branded milk and milk products,” Dhiral Shah, an analyst at GEPL Capital, told ETMarkets.com

“Long-term investors will benefit from investment in diary players over time as increasing focus on value-added dairy segments followed by brand building and scaling up of operations will eventually benefit the organised players in the coming years,” he said.

The dairy sector under the FMCG theme is not very big, and companies that dominate the space include Hatsun Agro, Mahaan Foods, Milkfood, Modern Dairies, Nestle, Parag Milk, Prabhat Dairy, Umang Dairies, Vadilal Industries and Kwality, among others. Besides Nestle, most of these companies are either smallcap or midcap players. The participation of domestic institutional investors as well as foreign investors is pretty low on these counters. The stocks that have survived the test of time include big names such as Parag Milk, Nestle, Hatsun Agro and Milkfood.

Investors need to understand that dairy is an extremely competitive and low-margin business, where the only differentiation could be in procurement/logistics and then a little bit in branding, experts said.

“Procurement and logistics are very much dependent on volumes and the scale of processing operations. It takes a long time to build a brand. The other challenge is that it is an extremely localised industry, mainly because the perishable nature of products limits reach,” Pankaj Sharma, Head of Equities, Equirus Securities, told ETMarkets.com.

“Not many of the foreign firms are successful in this business. It took 40-50 years to build Amul. To some extent, Mother Dairy can be called a national player. Apart from these two, there is no other brand with this kind of recall,” he said.

Going ahead, most analysts expect organised dairy players to increase presence on the back of the government initiative to boost the industry. The sector has drawn attention from fairly big players on the back of increasing consumer preference for branded products.

A major boost in demand has been observed in the value-added segments such as curd, lassi, butter milk, flavoured milk, yoghurt and cheese.

“On account of significant demand in the value-added segment, we do expect it to grow at more than 15 per cent annually,” Kumar Sudhanshu, Director & Research Head, Amrapali Aadya Trading & Investments, told ETMarkets.com.

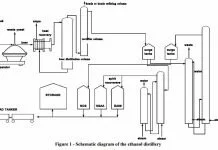

“We believe increasing interest from the larger players in the dairy industry will entail significant investment in creating capacities for milk procurement, milk handling and product manufacturing. We foresee enough potential to grow for the long term,” he said.

Top 4 stocks to bet on:

Prabhat Dairy: Prabhat Dairy does a lot of institutional business, which certainly offers a competitive advantage. But even otherwise, the business is completely commoditised and there are no differentiations possible in terms of technology, said Sharma of Equirus Securities.

Heritage Foods & Kwality: Shah of GEPL Capital said his top recommendation in the dairy industry is Heritage Foods followed by Kwality. Increasing contribution from value-added products in the overall diary segment will benefit Heritage Foods going ahead. Also, shifting focus from B2B to B2C will augur well for Kwality going ahead.

Parag Milk Foods: Sudhanshu of Amrapali Aadya is positive on Parag Milk Foods, which he thinks is well placed to take advantage of increasing demand in the future on the back of rising distribution network, strong brand equity and its presence in all verticals of the value pyramid.

Kwality: Due to lack of large sized players in the dairy sector, it is advisable to have a basket style of investment. “Kwality seems better placed to capture the growth potential being the largest player having strong presence in North India considered the biggest consuming market in the country,” Jimeet modi, CEO, SAMCO Securities told ETMarkets.com. The stock is available at fair price and has some amount of margin of safety at the current juncture.

Comments

comments