Source: economictimes.indiatimes.com

Many mid-sized private dairy firms in India are being sold to foreign companies as the next generation isn’t really keen on taking over the responsibility of running them in the face of dwindling profits and mounting challenges.

Tirumala Dairy, for instance, was sold to Lactalis early last year, and many more mid-sized dairy players such as Creamline Dairy, Dodla Dairy and Dinshaw’s Dairy may be sold too, according to investment bankers familiar with the matter.

“Heirs of first-generation promoters are keen on urban-centric businesses than dealing with cattle and farmers in rural areas, and are coaxing their parents to divest businesses at attractive valuations,” said an investment banker advising a couple of dairy firms, requesting anonymity.He said there are at least 20 such companies in various regions of the country with annual turnovers between ` . 300 crore and `. 1,000 crore.

“These dairy firms have been in talks with various global in vestors for the past several months to divest their businesses, but no deals were sealed owing to differences in valuations.In certain cases, few promoters are not interested in exiting, but others are being forced to sell by their kids,” said the same investment banker quoted above.

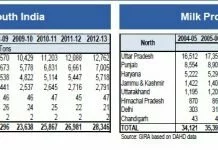

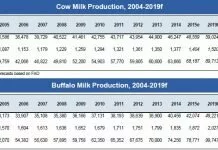

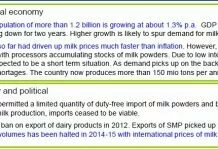

India Ratings estimates the Indian dairy sector, the world’s largest milk producer, to reach . 5.54 lakh crore by March next ` from ` . 3.59 lakh crore in March 2013. The agency expects India to produce 151 million tonnes of milk by March 2016 from 138 million tonnes in March 2014.

Immediately after selling his firm to French dairy giant Lactalis last January, founder chairman of Tirumala Dairy Bolla Bramha Naidu told ET: “The next generation of promoters’ families is not gelling well and they are not keen on continuing with the dairy business.”

A chief executive of another private mid-sized dairy firm, who didn’t want to be identified, said, “Most private dairies in India were set up by multiple promoters, who got along well for decades to build their firms. Unfortunately, the next generation is neither gelling well nor interested in taking their businesses to the next level.”

While most mid-sized dairy firms need sizeable funds to scale up their operations to stay competitive and improve their margins through value-added products, multinational dairy giants and private equity firms have seized the opportunity and have either invested in them or are tapping them.

India Ratings’ dairy sector analyst JB Sivakumar says successors are reluctant to remain in the dairy business, given the low profit margins and the nature of challenges related to cattle and expanding operations.

“Mid-sized private dairies are struggling to scale up operations and expand to other geographical markets owing to excess capacities in the sector and falling margins. They are also finding it tough to compete with cooperatives that are being backed by various state governments,”said Sivakumar.

“In the backdrop of increasing interest by foreign and private equity players with deep pockets, the Indian dairy industry is headed for consolidation.”

The promoters of private equity investor Black River Asset Management-backed dairy firm Dodla Dairy are not sure if the next generation could take it forward to build billion-dollar empires. “The new generation is keen on attractive, new economy businesses with high margins. I am not sure if my daughters would take my business forward,” said Dodla Dairy’s MD D Sunil Reddy.

Comments

comments