Source: fnbnews.com

In the booming food processing sector in India, the dairy segment has been somewhere left behind due to crunch in cold storage capacity. This is evident, especially, with regard to the cheese market whose exponential growth is clipped by lack of adequate cold storages.

R S Sodhi, managing director, GCMMF Ltd (Amul), in a telecon with Pushkar Oak talks about the dairy industry, the challenges that it is facing in view of issues such as poor FDI inflow in cold storages and the underlying benefits in

tackling them. Excerpts:

How is the dairy industry likely to benefit from FDI (foreign direct investment)?

FDI has always shown to have gained better business in developing countries and in India too, it will help in overall improvement in infrastructure and once FDI comes into play, the quality of the products will improve. Food processing sector is one such example. Today FDI has enabled India to have cold chains. There are huge foreign players who are investing in the cold chain mechanism.

How can the dairy industry encash PM’s Make in India campaign?

Make in India campaign is definitely supporting the industry in making business. Government has designed policies to make a favourable environment for foreign players to invest. There are loans offered and advisories set up with Badal, ministry of food processing industries. Foreign or interested businessmen can avail the facility by establishing a dialogue with food processing ministry.

Why the dairy industry does not voice out its issues, when food manufacturers and others are doing so by approaching the government?

What will it help? What will the government do? It has already laid down before people that it will be providing loans to people for opening cold chain. There are several cold chains which exist but the quality is miserable. Our products cannot be assured safety. There, I think, we (dairy industry players), on our own, are setting up cold chains in our own factories and also at certain hubs where we need it.

Are there any long-term plans for Amul to tie up with international companies?

No, no such plans for any of the new advancements. Instead, we have come up with an in-house machinery equipment manufacturing facility of our own at Amul to meet the customised machinery requirements. This facility addresses our machinery issues and develops new machinery too to suit our needs. Our R&D team avails perfect precision through their perfect design and consistent effort. In the above mentioned in-house machinery wing, we have a French solution provider who adds up to our expertise.

Why is it that the northern belt from Punjab to Bihar has cold chain/ storages but such a belt is missing as one moves towards south? What are the reasons?

Most of these cold chains have storages of potatoes rather than any other perishable commodities. The share of perishable commodities is very less. Mostly southern belt only has cold chains in the states of Karnataka and Maharashtra. Rather there are cold chains in other storages which are scattered and may not be there near the dairy processing plants. Dairy processing plants have their own cold storages as they need proper attention to the temperature and humidity and the third party cannot be trusted easily. Thus, dairy processing factories have their own cold storages. Even the southern belt has the same idea when it comes to dairy processing and storage.

What is the solution to increase the cold storages for perishable products?

Where there is market there are cold storages and where processing takes place there are very few cold storages which lead to loss. Thus, cold storages should be developed at the manufacturing hubs or a chain of refrigerated van transport should be established.

But we have to give some time. Fortunately, cold storages are coming up in various areas. Once foreign investments are regular in practice it will give a boost to the development of the cold chains. Even the rate at which the cold chains and storages are developing will be seen rising when foreign investments rise in India. The recent rigorous inspections on safety by government, which is good has resulted foreign investors to hesitate while investing in India.

Many cheese manufacturers complain of procuring low quality milk. What are the quality checks for milk that happen when milk is procured for cheese processing?

We, at Amul, have quality checks at every level. Beginning from the procurement level to the final end-product packaging. Yes, there is a need to get good quality milk into processing cheese. On the procurement stage itself, milk is checked to ensure that the milk procured is of fine quality. Later, we at our manufacturing unit, segregate milk as per market requirements like low fat milk and high fat milk.

The recently-held Global Economic Summit noted, “We have ample production but milk processing rates are only 2% out of whole production.” How can the dairy industry come out of this scenario?

Processing rates are low, as I mentioned earlier with regard to FDI, that the dairies which operate on smaller scale cannot avail benefits of processing. This is primarily due to the lack of investment in the mechanisation which is required in processing. We, at Amul, are investing our own money into setting up of the processing plants. FDI (companies) are not investing their money due to lack of cold chains. And FDI is not investing in cold chains because people are not ready to process the dairy products. A dairy product like cheese can be stored in a cold storage for a six month-long period before it hits the market. It is a vicious cycle which is interdependent for processing and cold chains and both are affected by FDI. Efforts should be made to develop both dairy and cold chains, simultaneously.

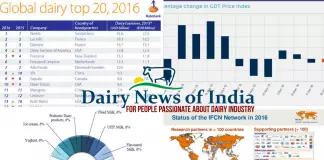

How big is the cheese market in India and on what scale is it growing at the global level, where does India stand in consumption, production and exports?

In India, cheese market is growing at a rate of 15 to 20 per cent. The cheese industry accounts to just around Rs 1,000 crore which is a mere contribution and is just negligible if compared globally. Forget about the exports, cheese as a commodity has no chance to stand before the foreign players in terms of quality. It has to even penetrate in Indian markets. The cheese market is still in its stage of infancy.

What is the difference in the milk market with regard to pasteurised milk and unpasteurised milk?

Amul procures milk and has its own pasteurising processes in various plants spread across India. If we see, the two types of milk available, they can be sourced from packaged milk which will be available in pasteurised form while the local cattle breeders have their own local network which can be accounted for a share of 25 per cent even today. Earlier the share of pasteurised milk was only 40 per cent, which increased to 75 per cent in the last two decades.

What is the progress of the dairy parks of Amul in Faridabad, Kanpur, Lucknow, Kolkata? What are the various products to be processed?

The dairy plant of Faridabad will be operational in next 20-25 days. The plants of Kanpur and Lucknow will be operational within next six months and one in Kolkata will take a year to be operational. All these plants will have regular processes under the umbrella of brand Amul like cheese, milk, casein (a protein base found in several dairy products) and milk powder.

Which state in India has highest procurement volumes of milk for Amul? How much growth in milk production is visible from these states?

Certainly, Gujarat as we have our hub there and it is one of the largest milk producers. We are procuring large volumes of milk from other states like Maharashtra, Haryana, Rajasthan, Punjab. Around 5-6 per cent growth is visible every three years in milk procurement.

Comments

comments