Tata Sons – News, Updates & Analysis

When talking about Tata Sons, the holding company that steers the Tata Group’s diversified businesses. Also known as Tata Sons Limited, it owns major stakes in companies ranging from steel to consumer goods and drives the group’s long‑term vision.

Connected to Tata Group, a multi‑industry conglomerate with roots in India’s industrial history. The Group spans automotive, IT services, hospitality and dairy, among other sectors. Because Tata Sons holds the majority voting power, decisions made at the holding level ripple across all these businesses.

Another key player is the Indian stock market, the platform where Tata‑related companies are listed and traded. Movements in Tata Sons’ shareholding patterns or trust fund allocations often trigger market reactions, influencing investor sentiment toward Indian conglomerates.

Corporate governance is the glue that holds this structure together. Strong board practices, transparent reporting and the influence of philanthropic trusts shape how Tata Sons allocates capital and pursues growth. In turn, these governance standards set benchmarks for other Indian conglomerates, encouraging better accountability across the sector.

Readers will find a mix of recent rain‑related disruptions in Delhi, fresh IPO announcements, and sports event coverage that illustrate how Tata Sons’ decisions intersect with broader economic and social trends. The collection below shows the real‑world impact of a holding company that not only owns businesses but also steers policy, market dynamics and community initiatives. Dive in to see how Tata Sons continues to shape India’s corporate landscape.

Arvind Chatterjee, Oct, 9 2025

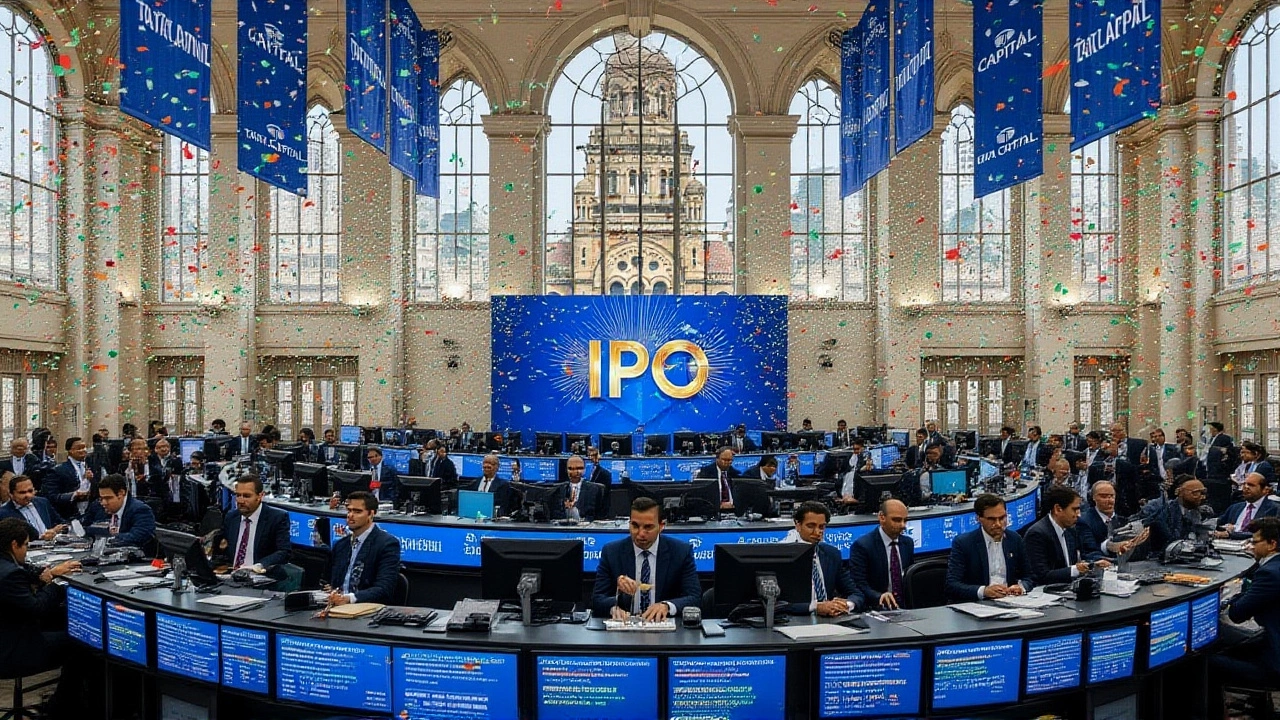

Tata Capital IPO Opens Oct 6, Fully Subscribed, Listing Oct 13

Tata Capital's IPO opened Oct 6, fully subscribed by Oct 8, and will list on NSE and BSE on Oct 13. The ₹15,511 crore offer saw a low grey‑market premium but strong backing from Tata Sons and analysts.

View More