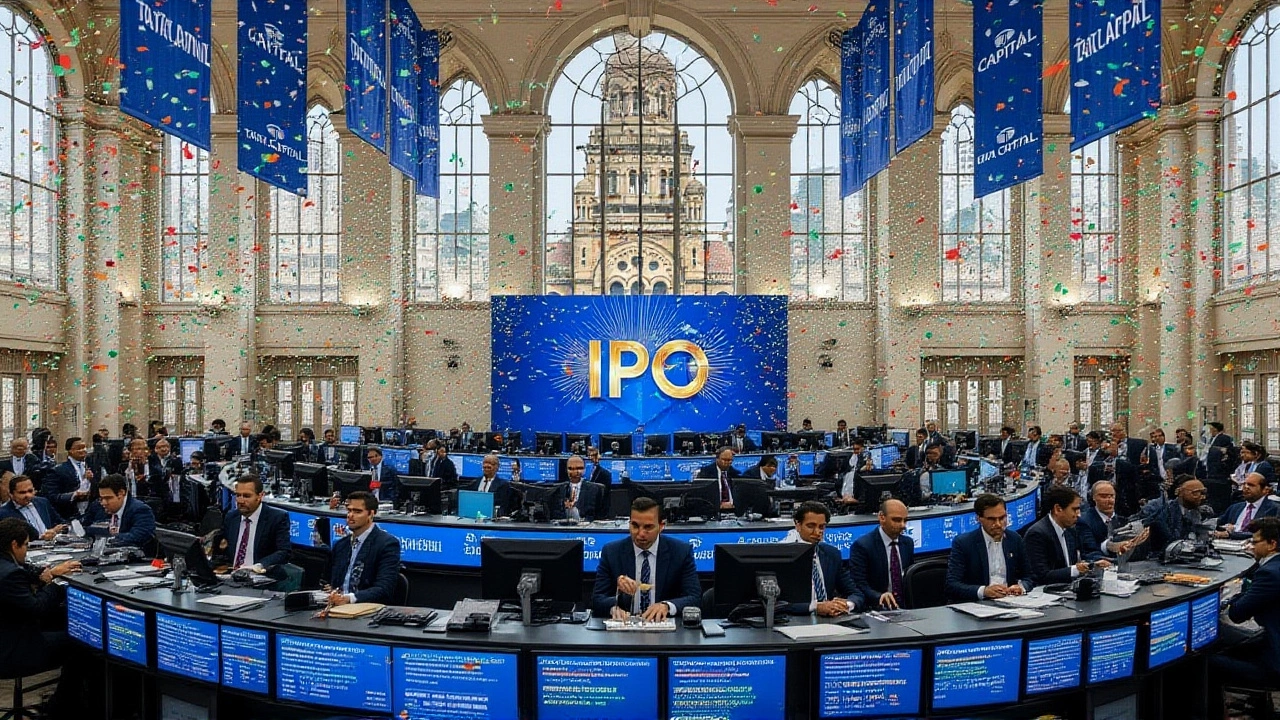

When Tata Capital Limited launched its initial public offeringMumbai on October 6, 2025, the market held its breath. The three‑day subscription window closed on October 8 with every share taken, and the listing was set for October 13 on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Investors poured in roughly $1.7 billion, making it the biggest IPO in India this year.

Background: Tata Capital’s Evolution

Founded in 2007 as the finance arm of Tata Sons, Tata Capital has grown into a full‑service NBFC, covering everything from commercial loans to wealth management and credit‑card distribution. Its flagship subsidiary, Tata Capital Housing Finance Limited, dominates the home‑loan segment, while a fledgling private‑equity arm chases growth in urbanisation, manufacturing and healthcare.

In early 2025 the company completed a landmark merger with Tata Motors Finance Limited. Approved by the National Company Law Tribunal (NCLT) on May 1 and effective May 8, the deal transferred over 183 million shares to TMF Holdings and added a sizable loan‑book, boosting Tata Capital’s lending capacity dramatically.

IPO Details: Size, Pricing and Subscription Mechanics

The offer was split into two buckets: a fresh issue of ₹6,846 crore and an offer‑for‑sale (OFS) of ₹8,666 crore by the parent Tata Sons. The total issue size therefore stood at ₹15,511 crore (about $1.86 billion). The price band was fixed at ₹310‑₹326 per share, with a minimum lot of 46 shares, meaning the smallest possible investment was ₹14,996.

Anchor investors placed bids on October 3, and the subscription tally surged each day. By the final day, Bloomberg reported a 100 % take‑up, confirming that demand outstripped supply across retail, institutional and foreign categories.

Market Reception & Grey‑Market Premium (GMP) Turbulence

Even though the issue was fully subscribed, the grey market premium—a barometer of short‑term investor sentiment—plummeted. On October 7 the GMP fell to a modest 3 %, and by the close on October 8 it slipped further to just 2 %. Analysts in The Times of India pointed to three headwinds: the sheer size of the deal, competitive valuations across the NBFC space, and lingering global market volatility.

Nevertheless, several brokerages issued bullish notes. Canara Bank Securities highlighted Tata Capital’s strong retail footprint, Anand Rathi Wealth praised its digital‑lending platform, while BP Capital and Mehta Equities underscored the group’s diversified revenue streams.

Impact of the Tata Motors Finance Merger

The May merger injected roughly ₹3,000 crore of additional loan assets and broadened coverage into vehicle financing. It also brought in a seasoned team experienced in asset‑based lending, which should accelerate Tata Capital’s push into SME and consumer credit. The combined entity now manages a loan‑book of over ₹120 crore, positioning it among the top ten NBFCs by assets.

Regulators cleared the transaction without condition, noting that the merged entity retained a capital adequacy ratio well above the RBI’s 15 % threshold. This regulatory comfort should appease cautious investors eyeing the sector’s recent stress events.

Analyst Views: Opportunities and Risks

From a valuation standpoint, the IPO sits at a price‑to‑book (P/B) multiple of about 2.5×, slightly above the sector average of 2.1×. Critics argue this premium reflects the Tata brand’s perceived stability, yet they warn that any slowdown in credit growth could compress margins.

On the upside, the firm’s non‑lending franchise—insurance distribution, wealth management and the newly announced Decarbonisation Fund—offers higher‑margin upside. The fund, earmarked for clean‑energy projects, aligns with the group’s ESG commitments and could attract institutional capital seeking green exposure.

What’s Next: Listing, Lock‑Ins and Investor Outlook

The shares are slated to debut on October 13, with the first trading price expected to hover near the top of the band given the oversubscription. Allotment will be finalized on October 9, and investors should see shares credited by October 10.

Anchor investors face a staggered lock‑in: 50 % of their allocation releases on November 8, 2025, with the remainder unlocking on January 7, 2026. The UPI‑mandate deadline is October 8 at 5:00 PM IST, and the final mandating date for any post‑allocation changes runs through October 23.

In short, the Tata Capital IPO marks a watershed moment for the Tata Group’s financial services push, and while short‑term market sentiment appears jittery, the long‑run fundamentals suggest a compelling play for investors comfortable with a multi‑year horizon.

Key Facts

- Issue size: ₹15,511 crore (≈ $1.86 bn)

- Price band: ₹310‑₹326 per share

- Subscription period: Oct 6‑8, 2025

- Listing date: Oct 13, 2025 on NSE & BSE

- Grey‑market premium fell to 2 % on final day

- Merger with Tata Motors Finance added ~₹3,000 crore in assets

Frequently Asked Questions

How does the Tata Capital IPO affect retail investors?

Retail investors can participate with a minimum lot of 46 shares, costing just under ₹15,000. Because the issue was fully subscribed, allocation will be on a pro‑rata basis, meaning most retail applicants will receive a fraction of the shares they applied for. The lock‑in period for anchors does not apply to retail holdings, allowing investors to trade freely after the listing on October 13.

What role did Tata Sons play in the offering?

Tata Sons acted as the promoter, selling ₹8,666 crore worth of existing shares through an offer‑for‑sale. This sale helped broaden the investor base and provided liquidity to existing shareholders while the fresh issue of ₹6,846 crore raised new capital for the company's growth plans.

Why did the grey market premium drop despite full subscription?

The dip reflected short‑term concerns over the deal’s size and valuation relative to peers, plus global market jitters that dampened appetite for large‑cap Indian IPOs. While brokerages remained optimistic, the GMP fell to 2 % as investors hedged against potential post‑listing volatility.

What are the expected benefits of the merger with Tata Motors Finance?

The merger adds roughly ₹3,000 crore of loan assets, expands the customer base into vehicle financing, and brings a seasoned asset‑management team. It also strengthens the balance sheet, improving capital adequacy and allowing Tata Capital to pursue larger corporate and SME lending opportunities.

When can investors expect the shares to be credited?

Allotment is scheduled for October 9, with the actual credit of shares to investors’ demat accounts on October 10. Trading will commence on the NSE and BSE the following Monday, October 13.