Source: timesofindia.indiatimes.com

Indian billionaire Ravi Jaipuria, PepsiCo’s biggest bottler in South Asia, is looking to enter the country’s highly unorganised Rs 3 lakh crore dairy market by extending his Creambell ice cream brand.

Jaipuria, who runs the largest Indian franchisee of KFC and Pizza Hut restaurants and has exclusive franchise rights for coffee chain Costa Coffee, is looking to buy a dairy plant here to manufacture value-added dairy products such as cheese, butter, lassi and yoghurt.

Industry experts say Jaipuria’s move is strategic since PepsiCo chief Indra Nooyi had said the food and beverage major will explore bringing dairy products into India such as ready-to-drink breakfasts. PepsiCo’s rival Coca-Cola is also firming up plans to enter the sector.

“Indians are increasingly looking at good-for-you products and dairy is one of them,” Jaipuria told TOI. “Earlier, people made dairy products such as yoghurt and paneer at home. But now, they prefer buying packaged products. The sector will get hotter in the future. If PepsiCo shows an interest in it, we are ready to tie up with them. It will take us around six to eight months to get everything in place.” At present, Jaipuria operates two dairy brands in Africa, Creambell and Daima.

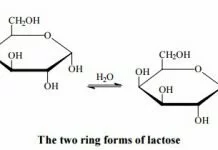

“India may be one of the largest producers of milk but per capita consumption is very low compared to the developed markets. Consumption can only grow when value-added dairy products become a part of the daily diet of Indian consumers like it has happened in the West. The market for value-added dairy products in India is in a nascent stage. For instance, branded dahi (yoghurt) is just 10% of the total dahi market in the country. These products add to a company’s bottomline since margins from plain milk is so low. Better margins will mean more spends on marketing by dairy companies, which we don’t see at present,” said Subhasis Basu, dairy head at Mother Dairy.

India’s dairy industry is likely to see high growth rates in the future, according to the National Dairy Development Board (NDDB). Demand for milk is set to touch 200 million tonnes by 2022 from 132 million tonnes in 2013, revealed a CARE Ratings report. Interestingly, value-added dairy products, such as yoghurt and lassi, have higher margins (12-18%) than milk (4-5%), attracting a slew of big private players such as Nestle, Amul, Mother Dairy, Britannia and Danone into the fray. Even Kolkata-based cigarette and FMCG player ITC has recently announced plans to enter the sector with a range of value-added dairy products.

Around 80% of India’s dairy industry is unorganised, according to industry estimates. Value-added dairy products constitute around 20% of total dairy market although branded products in the segment are still niche. Its share in milk and milk derivatives segment to grow at 25% Y-o-Y till 2019-20, according to CARE Ratings.

Industry experts say Jaipuria’s move is strategic since PepsiCo chief Indra Nooyi had said the food and beverage major will explore bringing dairy products into India such as ready-to-drink breakfasts. PepsiCo’s rival Coca-Cola is also firming up plans to enter the sector.

Comments

comments