Tata Capital IPO – Latest News, Analysis & Updates

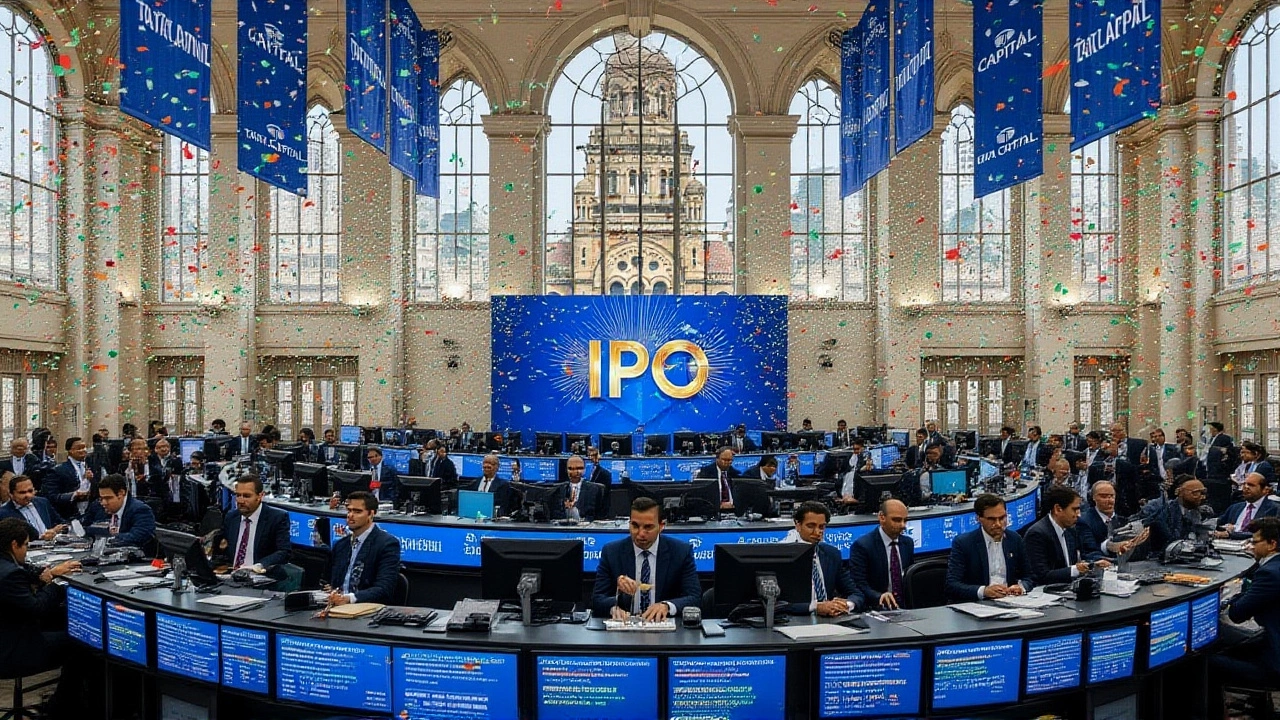

When working with Tata Capital IPO, the public offering of equity shares by Tata Capital Ltd., the financial services arm of the Tata Group, aimed at raising fresh capital and listing on Indian stock exchanges. Also known as Tata Capital's share offering, it marks a pivotal step for the conglomerate’s growth strategy.

The broader Initial Public Offering, commonly shortened to IPO, is the process through which a private company sells its shares to the public for the first time. An IPO requires a prospectus, pricing of shares, and a lock‑in period for promoters. In the case of the Tata Capital IPO, this means coordinating with underwriters, setting a price band, and meeting the disclosure standards set by regulators. The IPO also triggers a new class of shareholders, which expands the company’s capital base and increases market visibility.

Key Players and Regulations Shaping the Offer

Regulatory oversight comes from SEBI, the Securities and Exchange Board of India, which enforces compliance, reviews the draft prospectus, and grants final approval for listing. SEBI’s role influences the timing, pricing discretion, and disclosure depth of any Indian IPO, including Tata Capital’s. Meanwhile, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) provide the trading platforms where the shares will be listed and traded after the offer closes.

For investors, the Tata Capital IPO offers a chance to own a slice of the expansive Tata brand, known for its diversified businesses ranging from steel to IT services. Retail investors, institutional funds, and high‑net‑worth individuals all evaluate the offer based on valuation multiples, growth prospects, and the company’s asset quality. The success of the IPO will hinge on how well the pricing aligns with market appetite and how clearly the prospectus communicates the use of proceeds—whether for expanding loan portfolios, enhancing digital platforms, or strengthening capital buffers.

Recent market activity, such as the Ganesh Consumer Products IPO that raised ₹408 crore, shows that Indian investors are keen on well‑positioned firms with clear growth narratives. The Tata Capital IPO sits in the same competitive landscape, demanding solid investor relations, transparent governance, and a compelling story about the financial services sector’s future. As the filing window approaches, watch for the official price band, subscription levels, and any updates from SEBI that could affect the final listing date.

Below, you’ll find curated articles covering the latest announcements, expert insights, and practical tips for anyone interested in the Tata Capital IPO. Whether you’re a seasoned trader or a first‑time investor, the collection will give you a clear picture of what to expect and how to act when the shares hit the market.

Arvind Chatterjee, Oct, 9 2025

Tata Capital IPO Opens Oct 6, Fully Subscribed, Listing Oct 13

Tata Capital's IPO opened Oct 6, fully subscribed by Oct 8, and will list on NSE and BSE on Oct 13. The ₹15,511 crore offer saw a low grey‑market premium but strong backing from Tata Sons and analysts.

View More