Financial Services: How the Industry Shapes India’s Economy

When talking about Financial Services, the collection of activities that move money, manage risk, and support growth in the economy. Also known as financial sector, it includes everything from everyday banking to large‑scale capital markets.

In short, Financial Services power the whole economy.

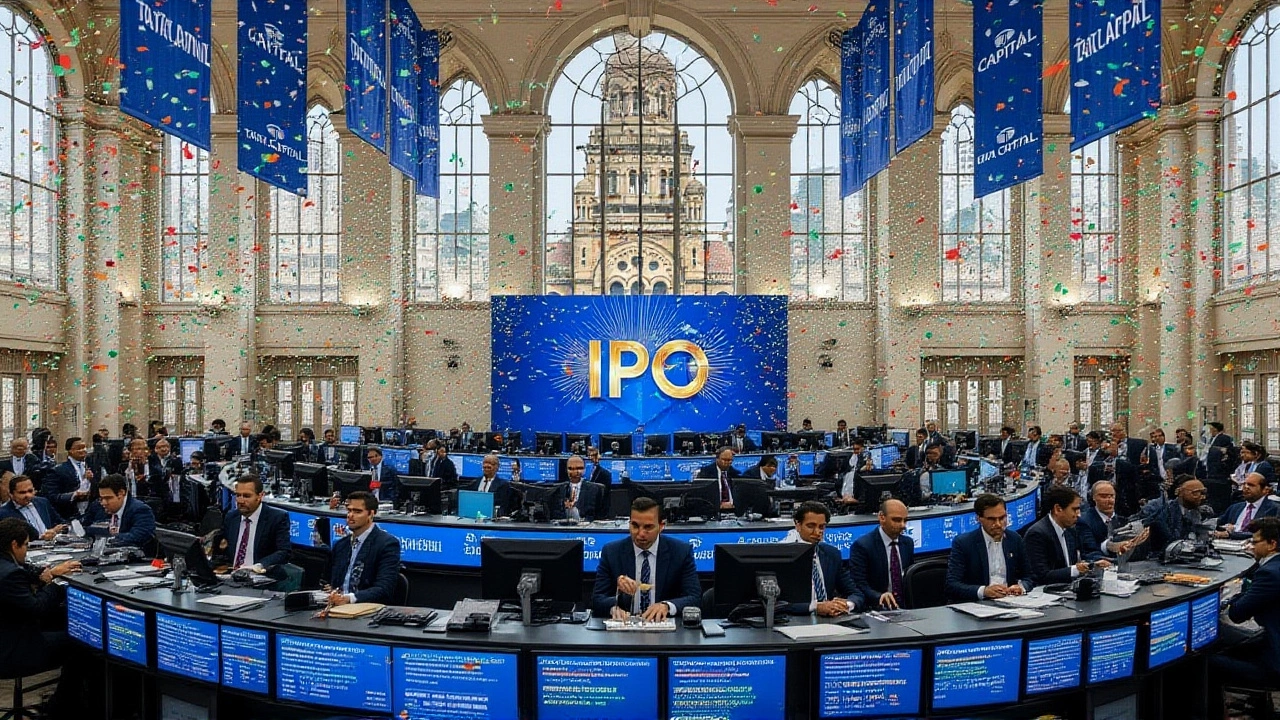

One core pillar is Banking, deposit taking, loan offering, and payment processing. Closely linked is Insurance, risk protection products for individuals and businesses, which cushions shocks and fuels confidence. The rise of Fintech, technology‑driven financial solutions like digital wallets and peer‑to‑peer lending is reshaping how customers interact with banks and insurers. Meanwhile, Investment Banking, advisory and capital‑raising services for corporations drives large transactions such as IPOs and mergers.

Key Components and Their Impact

Financial services rely on strict regulatory compliance, which ensures stability and protects consumers. Capital markets provide a platform for companies like Ganesh Consumer Products to raise funds through IPOs, linking the sector directly to economic growth. Digital payment systems, a subset of fintech, speed up transactions and lower costs for both merchants and consumers. Microfinance institutions bring credit to underserved areas, fostering entrepreneurship in rural India. Government policies, such as reforms announced by the Ministry of Finance, often trigger shifts in lending rates, insurance premiums, and investment flows.

The articles below illustrate how these pieces fit together. You’ll see a recent IPO that highlights investment banking activity, a weather event that impacted logistics and insurance claims, and policy updates that shape the banking landscape. Together they paint a picture of a dynamic financial services ecosystem that touches everyday life and big‑time business alike. Dive into the collection to see the real‑world examples that bring these concepts to life.

Arvind Chatterjee, Oct, 9 2025

Tata Capital IPO Opens Oct 6, Fully Subscribed, Listing Oct 13

Tata Capital's IPO opened Oct 6, fully subscribed by Oct 8, and will list on NSE and BSE on Oct 13. The ₹15,511 crore offer saw a low grey‑market premium but strong backing from Tata Sons and analysts.

View More