Low prices make dairy export to Russia unviable

India is unlikely to gain from the opening of Russian markets for hard cheese export due to price fall in international markets. As against the current Rs 350 a kg in Indian markets, skimmed milk powder (SMP) is quoted at Rs 180 a kg in international markets, including Russia. Hard cheese is being quoted in Indian markets at around Rs 400 a kg and Rs 200 a kg abroad. Butter is $5,000 a tonne here and less than $3,000 elsewhere.

This slump in global prices, by about 50 per cent, has taken place in the 16 months since Russian president Vladimir Putin announced the opening of his country’s market for Indian dairy products. However, global dairy markets seem to have begun a recovery and Indian dairy exporters could see an opportunity in the future, says R S Sodhi, chairman, Gujarat Co-operative Milk Marketing Federation, producer of the Amul brand of dairy products.

Amul has, sensing a coming opportunity in Russia, trebled its cheese production capacity to 120,000 tonnes a day from the earlier 40,000 tonnes per day, for an investment of Rs 600 crore. With its aggressive pricing, it has 96 per cent of the Indian butter market.

The Union commerce ministry had signed the protocol, mandatory procedural requirement to commence exports to Russia, on April 28. GCMMF has initiated talks with a couple of Russian cheese importers for future deals.

However, despite the reports of unviable prices, Govardhan brand dairy products producer Parag Milk Foods aims to dispatch a first consignment of hard cheese to Russia by the end of June.

“We have lined up a number of Russian buyers for hard cheese export. We were waiting for the government to sign the protocol to finalise the terms of trade with Russian buyers. Since the protocol has been signed by India, we expect the Russian government to reciprocate in two weeks. We would start negotiating terms of trade after that,” said Devendra Shah, managing director at Parag.

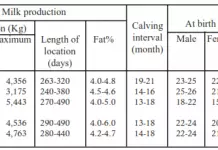

Rosselkhoznadzor, the Russain regulatory agency, had initially approved only Indian farms with at least 1,000 cattle under ownership. Only Parag and Schreiber Dynamix met these norms. Most large dairy farms in India, including GCMMF, operate under the co-operative model in which farmers remain the owner of cattle.

The government sought relaxation in this norm and Russia eventually agreed. According to Shirish Upadhyay, senior vice-president at Parag, the new Russian rules focus on sourcing of milk instead of number of cattle, to accommodate more exporters from India.

Russia’s annual cheese consumption is estimated at 230,000 tonnes and is being met largely through import from the Americas and its neighbors.

Comments

comments